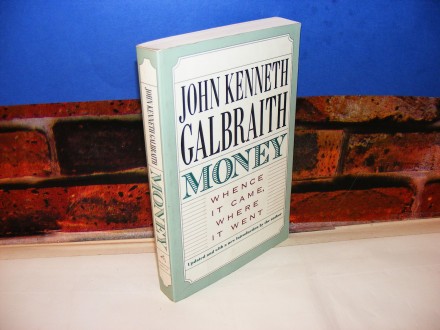

Ponuda "Money John Kenneth Galbraith" je arhivirana

The Moneychanger and Our John Willie

450 din.

Big money - John Dos Passos

190 din.

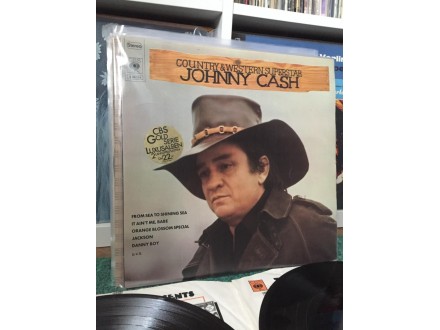

JOHNNY CASH (2xLP)

2.990 din.

Lil Wayne PROM QUEEN (maxi single)

1.990 din.

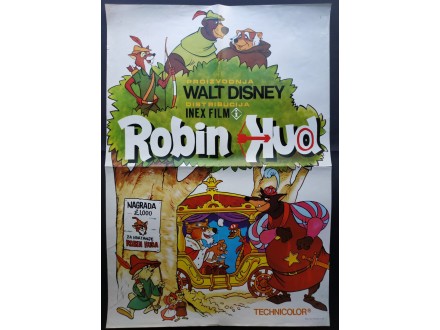

ROBIN HOOD filmski plakat WALT DISNEY

1.800 din.

Blues Roots, komplet od 10 LP

9.000 din.

V.A. - Blues Roots 1-10

8.000 din.

Living Chicago Blues 6XLP

6.000 din.

Simply Red – Home

254 din.

The Moneychanger and Our John Willie

450 din.

Big money - John Dos Passos

190 din.

JOHNNY CASH (2xLP)

2.990 din.

Lil Wayne PROM QUEEN (maxi single)

1.990 din.

ROBIN HOOD filmski plakat WALT DISNEY

1.800 din.

Blues Roots, komplet od 10 LP

9.000 din.

V.A. - Blues Roots 1-10

8.000 din.

Living Chicago Blues 6XLP

6.000 din.

Simply Red – Home

254 din.